An Unbiased View of Lamina Loans

Facts About Lamina Loans Revealed

Table of ContentsSome Known Facts About Lamina Loans.The Best Guide To Lamina LoansHow Lamina Loans can Save You Time, Stress, and Money.The 4-Minute Rule for Lamina LoansIndicators on Lamina Loans You Should KnowThe Facts About Lamina Loans Revealed

For example, customers might finish up paying much more in interest than they would have or else. Settling lendings may likewise remove benefits, such as passion rate price cuts, major rebates, and qualification for lending mercy or cancellation. You may have discovered information concerning other kinds of federal car loans, such as Perkins Loans, the Federal Family Education And Learning Funding (FFEL) Program and also the Health And Wellness Education Aid Funding (HEAL) Program.

Once you have possessed a home for a while and also you have actually constructed up some equity by making settlements, you can then request a finance called a credit line. This sort of financing enables you to access the funds whenever it is required. This product is a handy and also innovative way to handle your money as the cash can be made use of for virtually anything as well as repaid on your terms.

The 8-Minute Rule for Lamina Loans

Nevertheless, they can be really pricey if the balance of the line of credit is not on a regular basis reduced as it can have higher rate of interest and also decrease the equity in your house.

A line of credit scores is like a bank card, implying that it is essentially a pool of cash. You can obtain what you require when you require it as well as make payments just on what you make use of. Although this is an excellent method for companies to access the funding they need as needed, lines of credit score commonly have high compounded rate of interest.

Get This Report on Lamina Loans

If you can satisfy a few very easy certifications, you can get the cash you need in as little as 24-hour, deposited right into your business checking account. Repayment terms can be tailor-maked according to your particular situation. As you can see, there are lots of ways to elevate the capital you require to expand your company.

This information is not meant to be and must not be trusted as economic guidance. Consult with a CIBC consultant for details regarding CIBC lending items. Personal loaning products and also domestic home mortgages provided by CIBC undergo CIBC's financing standards and credit score approval. Trade name of CIBC.

Monetarily, fundings are structured between people, groups, and/or companies when someone or entity provides cash to one more with the expectation of having it settled, usually with interest, within a particular quantity of time. For instance, financial institutions often car loan cash to individuals with good credit who are seeking to acquire an automobile or home, or start a company, and also borrowers repay this money over a collection amount of time.

All about Lamina Loans

It is possible for people to provide tiny sections of cash to many others via peer-to-peer borrowing exchange services like Lending Club, and it prevails for a single person to lending another money for little purchases - Lamina Loans. How a funding is treated legitimately varies according to the sort of my review here finance, such as a home loan, and the terms discovered in a funding agreement.

Federal regulations are set out to protect both financial institutions as well as debtors from economic harm. Though individuals often obtain as well as offer on smaller scales without any agreement or promissory note, it is constantly suggested to have a created finance arrangement, as monetary disputes can be cleared up much more easily and rather with a created contract than with an dental contract.

Principal: The amount obtained that has yet to be paid off, minus any rate of interest. If somebody has taken out a $5,000 loan as well as paid back $3,000, the principal is $2,000.

Lamina Loans Can Be Fun For Anyone

Passion settlements greatly incentivize lenders to take on the financial danger of offering cash, as the suitable situation leads to a lender earning back all the cash lent, plus some percent over that; this produces a great roi (ROI) - Lamina Loans. Rates of interest: The rate at which a portion of the principal the amount of a lending yet owed is repaid, with passion, within a particular time period.

Pre-qualified: Pre-qualification for a funding is a statement from a banks that provides a non-binding and approximate estimate of the quantity an individual is eligible to obtain. Deposit: Money a customer provides to a loan provider upfront as part of a first loan settlement. A 20% deposit on a house that is valued at $213,000 would be $42,600 in link cash; the mortgage would cover the staying costs and be paid back, with interest, in time.

Some lenders really penalize borrowers with a passion charge for early payment as it triggers lenders to lose on interest costs they might have had the ability to make had the debtor kept the loan for a longer time. Repossession: The lawful right and procedure a loan provider uses to redeem monetary losses sustained from having a customer fail to pay back a loan; normally results in a public auction of the possession that was made use of for collateral, with profits going toward the home loan debt.

The Lamina Loans Statements

There are two main classifications of finance credit history. Open-end debt occasionally referred to as "rotating debt" is credit rating that can be borrowed from even more than once. It's "open" for continued borrowing. The most common form of open-end credit history is a charge card; a person with a $5,000 limit on a credit history card can remain to obtain from that line of credit score forever, supplied she repays the card month-to-month and also thus never satisfies or goes beyond the card's restriction, whereupon there disappears cash for her to borrow.

When a dealt with amount of cash is lent in complete with the agreement that it be settled completely at a later date, this is a form of closed-end debt; it is likewise known as a term lending. If an individual with a closed-end home loan of $150,000 has paid back $70,000 to the lending institution, it does not indicate that he has another $70,000 out of $150,000 to obtain from; it just suggests he is a part of the way via his payment of the full finance amount he currently received and utilized.

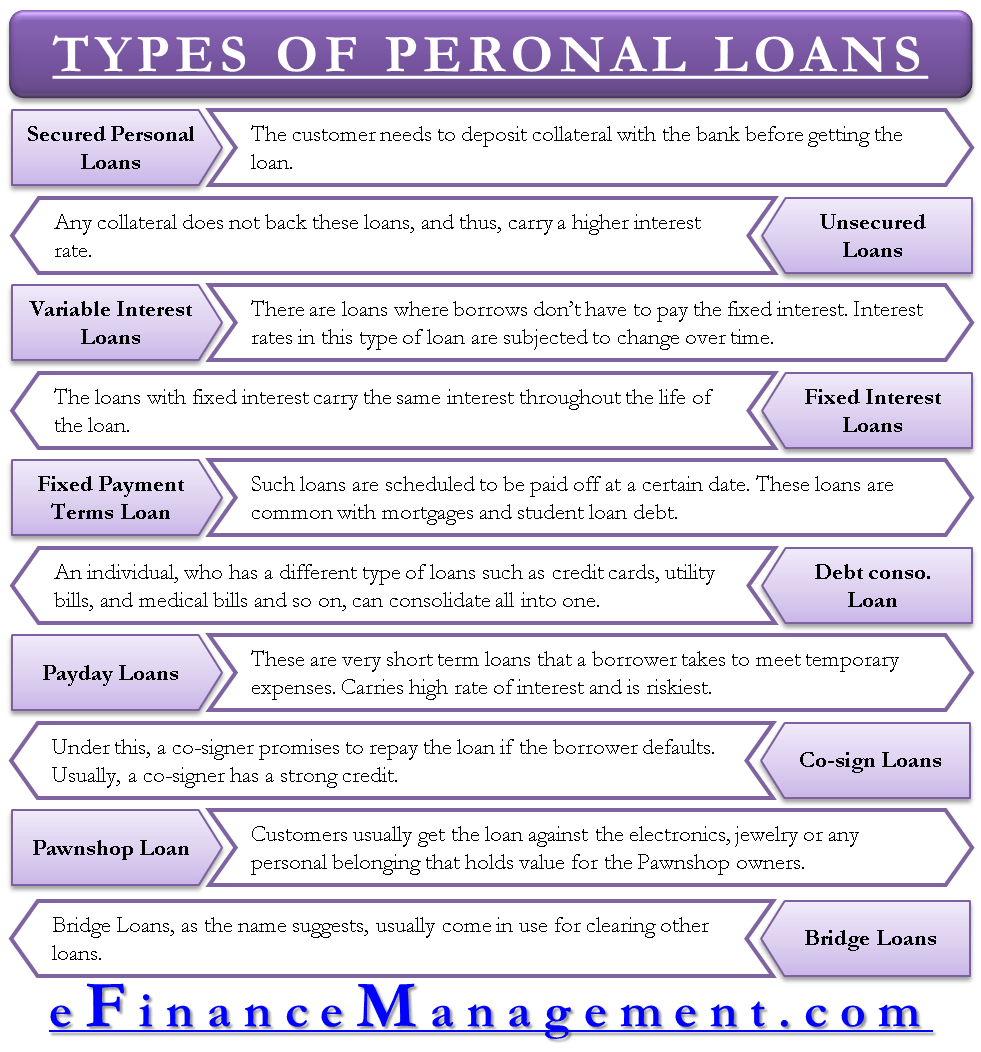

Finances can either be protected or unsecured. Unsafe lendings are not affixed to possessions, implying lenders can not place a lien on a possession to redeem monetary losses in case a borrower defaults on a finance (Lamina Loans). Applications for unprotected lendings are rather authorized or declined according to a consumer's revenue, click now credit scores background, and credit history.