Installment Loans for Beginners: Step-by-Step Guide

The Ins and Outs of Loans: Browsing Your Financing Options With Self-confidence

Maneuvering the complicated landscape of loans needs a clear understanding of various kinds and vital terms. Lots of individuals locate themselves overwhelmed by choices such as individual, automobile, and trainee loans, along with essential ideas like rate of interest rates and APR. An understanding of these principles not only help in evaluating economic demands however likewise improves the loan application experience. Nonetheless, there are significant variables and usual pitfalls that borrowers should recognize before continuing better.

Comprehending Different Sorts Of Loans

Loans function as crucial monetary tools that satisfy different needs and purposes. Organizations and people can select from a number of kinds of loans, each developed to fulfill details requirements. Individual loans, frequently unsecured, offer debtors with funds for various individual expenses, while car loans allow the acquisition of cars via secured funding.

Mortgage, or home loans, help purchasers in acquiring residential property, usually including long repayment terms and specific rate of interest. Student loans, targeted at funding education, commonly included reduced interest rates and credit options up until after graduation.

For organizations, commercial loans provide necessary capital for expansion, equipment purchases, or functional expenses. Furthermore, payday advance loan provide fast cash money remedies for immediate needs, albeit with higher rate of interest. Comprehending the different sorts of loans enables borrowers to make educated decisions that line up with their economic goals and circumstances.

Secret Terms and Ideas You Must Know

When maneuvering loans, recognizing key terms and ideas is crucial. Interest prices play an essential function in figuring out the expense of borrowing, while various loan types deal with different economic requirements. Knowledge with these elements can empower individuals to make informed decisions.

Rates Of Interest Discussed

Just how do rates of interest impact loaning decisions? Rates of interest represent the cost of obtaining cash and are an important variable in financial decision-making. A greater rates of interest boosts the total cost of a loan, making borrowing much less enticing, while lower prices can incentivize debtors to tackle debt. Lenders usage rate of interest to mitigate risk, mirroring debtors' creditworthiness and prevailing economic problems - Payday Loans. Dealt with rates of interest continue to be continuous throughout the loan term, supplying predictability, whereas variable rates can fluctuate, potentially causing greater payments in time. In addition, recognizing the annual percent price (APR) is crucial, as it includes not simply interest however likewise any type of associated costs, offering a detailed sight of loaning prices

Loan Enters Review

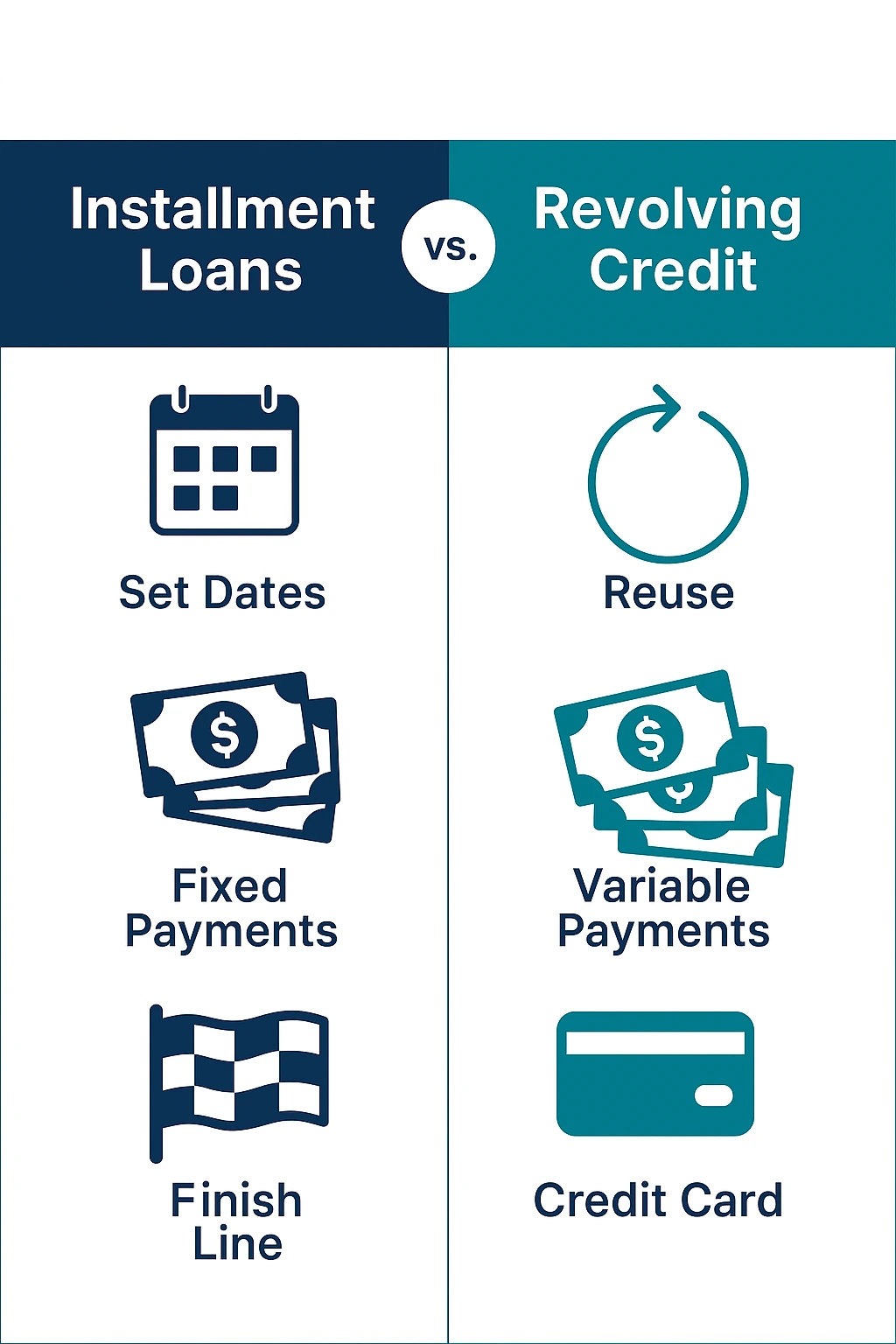

Maneuvering the landscape of loan types is essential for consumers seeking one of the most ideal financing choices. Understanding various loan types assists people make notified choices. Personal loans are commonly unsafe, excellent for combining financial debt or funding individual tasks. Mortgages, on the various other hand, are protected loans particularly for acquiring property. Automobile loans offer a comparable purpose, financing car acquisitions with the lorry as security. Organization loans deal with entrepreneurs needing funding for procedures or expansion. One more alternative, pupil loans, aid in covering instructional expenses, commonly with positive settlement terms. Each loan kind provides unique terms, rates of interest, and qualification requirements, making it essential for customers to evaluate their financial requirements and abilities before dedicating.

The Loan Application Process Described

What steps must one take to efficiently navigate the loan application process? First, people need to assess their economic needs and figure out the kind of loan that straightens with those demands. Next off, they must examine their debt report to confirm accuracy and recognize areas for improvement, as this can impact loan terms.

Following this, borrowers should collect required documentation, including evidence of revenue, employment history, and financial declarations. As soon as prepared, they can approach lenders to ask about loan items and passion rates.

After choosing a lending institution, finishing the application type precisely is important, as errors or omissions can delay processing.

Candidates should be all set for prospective follow-up demands from the loan provider, such as added documentation or explanation. By adhering to these actions, people can boost their opportunities of a reliable and smooth loan application experience.

Factors That Influence Your Loan Approval

When considering loan approval, several important factors come into play. 2 of the most significant are the credit history and the debt-to-income ratio, both of which supply lending institutions with insight into the consumer's monetary stability. Comprehending these aspects can considerably boost a candidate's opportunities of securing the desired financing.

Credit Score Relevance

A credit score works as a critical standard in the loan approval procedure, affecting lending institutions' understandings of a debtor's financial reliability. Normally ranging from 300 to 850, a higher score shows a background of accountable credit usage, including prompt payments and reduced credit report application. Different factors add to this score, such as repayment history, length of website credit report background, sorts of credit score accounts, and current credit history questions. Lenders make use of these ratings to evaluate danger, figuring out loan terms, passion prices, and the likelihood of default. A strong credit history not just boosts approval chances yet can additionally bring about extra favorable loan problems. Alternatively, a reduced score may lead to greater rates of interest or denial of the loan application completely.

Debt-to-Income Proportion

Many loan providers take into consideration the debt-to-income (DTI) proportion a crucial element of the loan authorization process. This financial metric contrasts an individual's regular monthly financial debt payments to their gross month-to-month earnings, giving understanding into their ability to handle additional debt. A lower DTI ratio indicates a much healthier monetary situation, making debtors extra attractive to lending institutions. Aspects influencing the DTI ratio include housing prices, bank card balances, trainee loans, and other recurring costs. In addition, adjustments in earnings, such as promos or work loss, can substantially affect DTI. Lenders generally like a DTI proportion below 43%, although this threshold can vary. Recognizing and handling one's DTI can improve the possibilities of safeguarding positive loan terms and rate of interest.

Tips for Managing Your Loan Properly

Usual Mistakes to Stay Clear Of When Getting a Loan

Additionally, numerous individuals hurry to accept the very first loan offer without comparing options. This can lead to missed opportunities for better terms or reduced prices. Customers ought to additionally avoid taking on loans for unneeded expenses, as this can result in long-lasting debt troubles. Ultimately, overlooking to examine their credit history can prevent their capacity to secure beneficial loan terms. By recognizing these pitfalls, debtors can make educated decisions and browse the loan process with better confidence.

Regularly Asked Concerns

Exactly How Can I Boost My Credit Score Before Getting a Loan?

To improve a credit score before getting a loan, one must pay bills on schedule, lower arrearages, inspect credit report records for errors, and prevent opening brand-new credit score accounts. Regular monetary habits yield favorable outcomes.

What Should I Do if My Loan Application Is Denied?

Exist Any Type Of Charges Linked With Loan Early Repayment?

Funding early repayment costs might use, relying on the lending institution and loan kind. Some loans consist of charges for early settlement, while others do not. It is crucial for borrowers to evaluate their loan contract for specific terms.

Can I Work Out Loan Terms With My Loan provider?

Yes, customers can discuss loan terms with their lending institutions. Variables like credit report, settlement background, and market conditions might influence the loan provider's readiness to modify rates of interest, repayment schedules, or costs related to the loan.

How Do Rate Of Interest Prices Impact My Loan Settlements Gradually?

Rate of interest prices considerably influence loan settlements. Higher prices lead to raised monthly payments and total rate of interest expenses, whereas reduced rates lower these costs, eventually impacting the consumer's general economic concern throughout the loan's duration.

Numerous individuals discover themselves overwhelmed by options such as individual, car, and trainee loans, as well as crucial principles like passion rates and APR. Rate of interest rates play an essential duty in figuring out the cost of loaning, while various loan types cater to various monetary demands. A higher rate of interest rate enhances the total expense of a loan, making borrowing less enticing, while reduced rates can incentivize consumers to take on financial obligation. Repaired rate of interest prices remain consistent throughout the loan term, offering predictability, whereas variable rates can vary, potentially leading to greater repayments over time. Finance prepayment fees might use, depending on the lending institution and loan type.